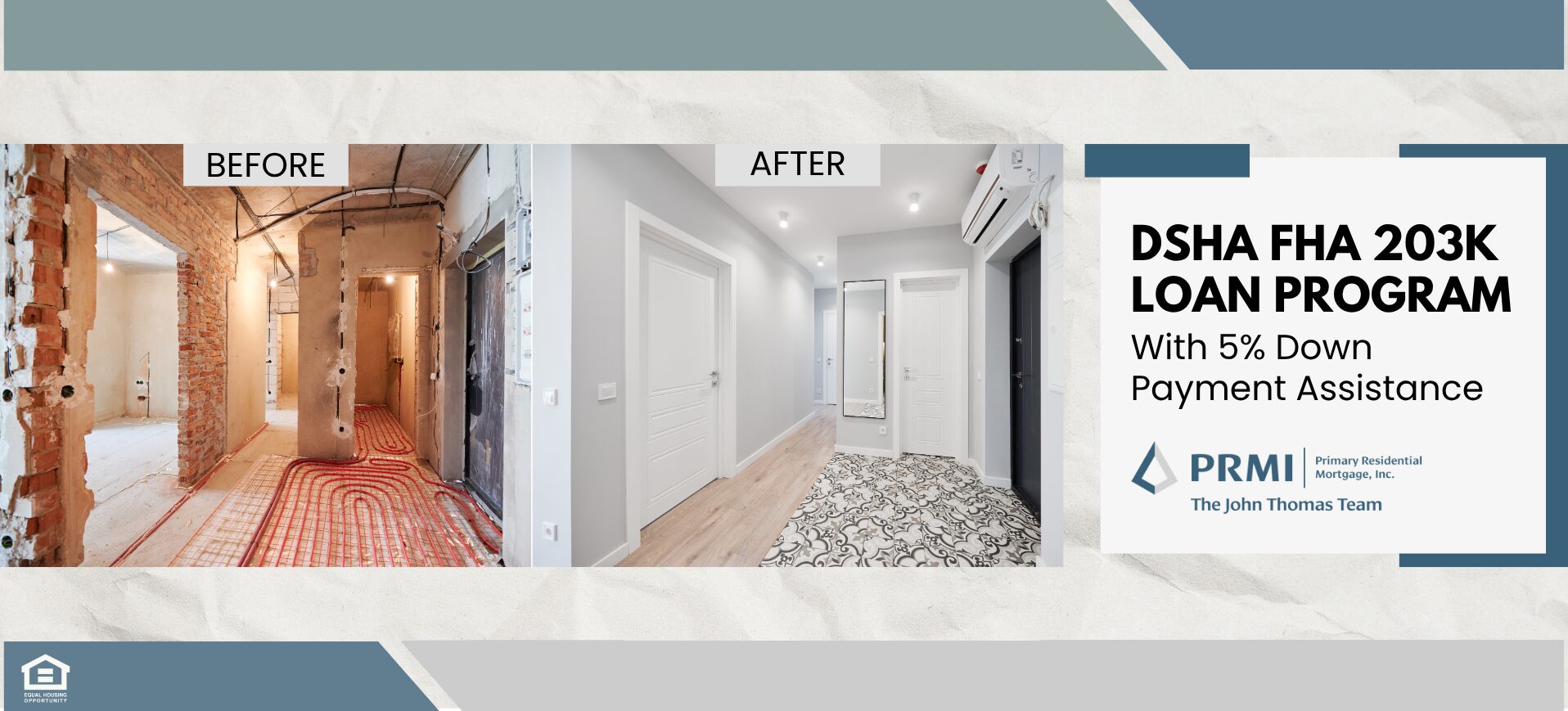

DSHA FHA 203k Loan Program: Renovate Your Home with 5% Down Payment Assistance

Are you buying a home in Delaware that needs repairs or updates but short cash to close? The DSHA FHA 203k Limited Loan Program is a powerful mortgage option that allows you to finance both the purchase and renovation of a primary residence—with help from the Delaware State Housing Authority’s (DSHA) 5% down payment and closing cost assistance to make your home purchase more affordable.

This is a top option for first-time homebuyers in Delaware looking to purchase and renovate with one streamlined loan and get a 5% DPA Program. Find out if you qualify today by calling the John Thomas Team at 302-703-0727 or APPLY ONLINE.