Delaware FHA Loan Limits for 2019

Delaware FHA Loan Limits for 2019 were raised in all three counties of Delaware effective January 1, 2019. The Federal Housing Administration increased its mortgage loan limits by almost 7% for the new year, mirroring the increase in conventional loans. The new base loan limit maximum was increased from $294,515 to $314,827 for a single unit home. In some high-cost areas of the country, the maximum loan limit was increased to $726,525. The department of Housing and Urban Development (HUD) released Mortgagee Letter 2018-11 on December 14, 2018 which increased the loan limits for 2019 nationwide for all Forward Mortgage loans insured by FHA. Call 302-703-0727 to apply for a Delaware FHA Loan or get started online at http://www.PRMILoanApplication.com

The FHA national low-cost area mortgage loan limits are set at 65 percent of the national conforming limit of $484,350 for a one unit property. The new loan limits nationally are as follows:

One Unit – $314,827

Two Unit – $403,125

Three Unit – $487,250

Four Unit – $605,525

What determines the FHA Loan Limits for each County?

The Federal Housing Administration (FHA) calculates the mortgage loan limits based on the median home prices in accordance with the National Housing Act. FHA’s single family mortgage loan limits for forward mortgages are set using Metropolitan Statistical Areas (MSA) and county areas. FHA publishes updated limits effective for each calendar year. FHA sets the maximum FHA Loan limits at or between the low-cost area and high-cost area limits based on the median home prices for the area.

What are the New Delaware FHA Loan Limits for 2019?

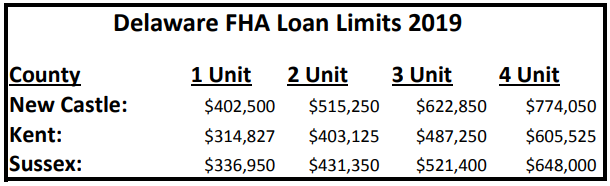

Delaware has three counties: New Castle County, Kent County, and Sussex County. The maximum Delaware FHA loan limit is different in all three counties. Below is chart showing the maximum loan limit in each county:

Single Family FHA Loan Limits for 2019:

New Castle County Delaware has a maximum FHA Loan limit of $402,500

Kent County Delaware has a maximum FHA loan limit of $314,827

Sussex County Delaware has a maximum FHA loan limit of $336,950

The FHA Loan limits are the same for a standard Delaware FHA Loan as well as a Delaware FHA 203k Loan. The FHA Reverse Mortgage Loan limits are different that than the forward mortgage limits.

What are the FHA Loan Limits for High Cost Areas?

The FHA High Cost Area Loan Limits are set at 150 percent of the national conforming loan limit of $484,350 for a one unit property. Below are the limits for properties with 1-4 units:

FHA Loan limit One Unit – $726,525

FHA loan limit Two Unit – $930,300

FHA Loan limit Three Unit – $1,124,475

FHA Loan limit Four Unit – $1,397,400

How Do You Apply for a Delaware FHA Loan?

You can apply for a Delaware FHA Loan by calling 302-703-0727 or you can APPLY ONLINE with the John Thomas Team with Primary Residential Mortgage.