MacGray Matter – July 5, 2010

UNEMPLOYMENT NUMBERS ADD TO A NEGATIVE WEEK: On Friday, the Department of Labor reported that non-farm payrolls dropped by 125,000 jobs due largely to the Census Bureau laying off 225,000 temporary workers.

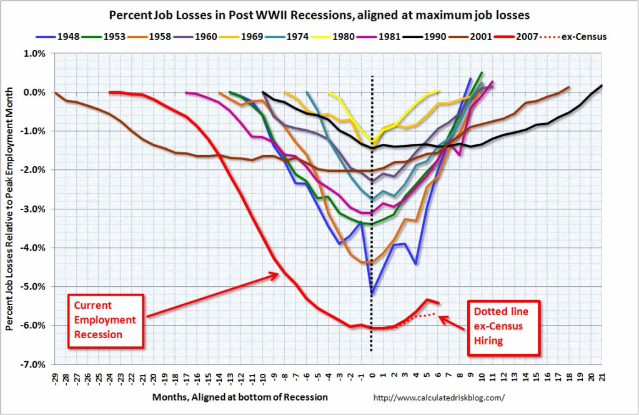

Private sector job growth was positive by 83,000 jobs, but that was less than “expected” and not near enough to make up for the loss of government jobs. Manufacturing jobs fell by 8,000 after a three-month positive streak. I continue to find this particular graph found on calculatedrisk.com (and used with permission) to be a key one to follow:

MANUFACTURING STILL GROWING, BUT THE GROWING IS SLOWING: In China, manufacturing growth slowed more than economists had forecast (according to Bloomberg). Also this week, a gauge of factory output in the 16-member Euro region weakened for a second month according to a survey by Bloomberg. The U.S. Institute for Supply Management’s manufacturing index fell more than economists forecast to 56.2 from 59.7 in May. Those numbers still indicate growth, but slowing growth.

CONSUMERS STILL WARY: Personal income rose in May by 0.4%, but consumer spending rates did not keep pace. Personal consumption increased by only 0.2%. This resulted in the national savings rate increasing to 4.0%, its highest level since last September. This slows the recovery, but adds to the overall, long-term financial health for the country and all those individuals who are saving, and not spending. A 4% savings rate is hardly excessive.

TOTALLY RED WEEK: Each day last week ended with negative returns in the domestic equity markets. The Dow Jones index was down 4.51% (down 7.11% for the year). The S&P 500 was down 5.03% (down 8.3% for the year), and the NASDAQ was down 5.92% (down 7.82% for the year). To give some additional perspective, for the last twelve months, the Dow is up 16.98%. The S&P 500 is up 14.07% for the last twelve months and the NASDAQ Composite is up 16.44%. We continue to be defensive in our portfolio management approach.

THE GIFT TAX OPPORTUNITY OF 2010: It seems more and more likely that Congress will do nothing with the current estate and gift tax this year. As a result, 2010 remains an outlier year. Currently, there is a $1 million exemption for the gift tax and an annual exemption of $13,000 per year.

Therefore, if you make a gift to your child of $1,013,000, you can claim the first $13,000 as the annual exemption, and the remaining $1 million as your lifetime exemption from gift tax. For any amount above those exemptions, the current tax (2010 only) is a flat 35%. In 2011, the top gift tax rate increases to 55%. Is it possible, given the current deficits being run up by the government, that the Congress will actually raise rates instead of lowering them? Of course, the answer is a resounding “yes”. Therefore, for individuals with large estates, this year may present an opportunity to transfer some of that wealth and avoid significant transfer tax.

MORE LABOR NUMBERS: I reviewed labor statistics from the U.S. Department of Labor on their website. Here are some numbers I found interesting. The reported population of the U.S. in June 2009 was 235,655,000. In June 2010, that number had increased by about 9/10 of one percent to 237,690,000. In June 2009, the civilian labor force was 154,759,000. In June 2010, that number had decreased by about 9/10 of one percent.

Therefore, even though the number of people employed from June 2009 to June 2010 fell by 919,000, the unemployment rate remains the same as it was one year ago: 9.5%. The number of persons reported as employed in the civilian labor force in June 2010 is 139,119,000, which is over 300,000 less than May 2010, and yet the unemployment rate dropped from 9.7% to 9.5%. The primary reason is that many of the temporary census workers who have been laid off were seniors or others who are not otherwise rejoining the workforce, and therefore, they do not get classified as unemployed.

GETTING OUT OF A CAR LEASE: It is possible, but generally not easy or pretty, to get out of a car lease. Your best option, of course, if possible is to keep paying for the lease until it ends. If you cannot due to the loss of a job or other financial reverses, what do you do? First, go to the car dealer.

The dealer may be able to strike a deal with you to 1) lower your payments, 2) preserve your credit, and/or 3) get you out of the car completely. This will likely cost you more than the balance on the lease. If your dealer is willing to work with you, there may be a way out. But beware: It WILL cost you something. The car dealer is not in the business of charity work. If the dealer will not work with you, consider a lease swap. Companies such as SwapALease.com or LeaseTrader.com will connect you to a buyer who, for an incentive, will take over your car lease, allowing you to walk away with no liability and no penalties or obligations. Before you list your car with a lease swap company, it is vitally important to check with your leasing company to see if they will allow this type of transfer. It will cost approximately $100 to list your car, and then there will be a contract transfer fee that could be as much as $200 or more. Listing your lease doesn’t mean getting out of your lease is a sure thing. If you are running close to your allotted mileage, you may not find a taker. Finally, you might be able to get out of your car lease by surrendering the car to the leasing company. You are not really getting out of anything as the company will sell the car, apply the proceeds to your balance, and sue you for the difference. Your credit score will take a hard hit.

Have a great week!

I’ll close with a picture I took with my Blackberry on a cruise through San Diego Harbor last week. That’s the U.S.S. Nimitz in the background:

Doug MacGray

HAPPY INDEPENDENCE DAY!

|

DouglaR. MacGray, J.D., C.F.P., C.E.A.

Principal, Senior Vice President of Financial Planning |

| 300 Conshohocken State Road, Suite 670 | W. Conshohocken, PA 19428 (610) 783-4265 (direct) | (302) 463-3377 (mobile)

dmacgray@compass-ionadvisors.com

Investment Advisory services offered through Comprehensive Capital Management, Inc. an SEC-Registered corporation. Securities offered through Comprehensive Asset Management and Servicing, Inc. Member, FINRA/SIPC/MSRB 2001 Rt. 46 Ste. 506, Parsippany, NJ 07054, 1-800-637-3211 |

All the perplexities, confusion and distress in America arise not from defects in their Constitution or Confederation, nor from want of honor or virtue, so much as downright ignorance of the nature of coin, credit, and circulation. John Adams in a letter to Thomas Jefferson in 1787

Proclaim liberty throughout the land to all its inhabitants. Leviticus 25:10 (inscribed on the Liberty Bell)

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713