Delaware Mortgage Rates Weekly Mortgage Market Update for September 22, 2014

Delaware Mortgage Rates weekly mortgage market update for the Week of September 22, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Newark, Delaware Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware Mortgage Rates were able to stabilize last week after moving higher for the past two weeks. If you look at the mortgage bond chart below you can see mortgage bonds have been on a downward trend which has moved mortgage rates higher but last week we were able to hammer out a floor of support. With the Fed Meeting behind us, we are looking to see if mortgage bonds can rally and move higher off the line of support seen in the chart below. Friday mortgage bonds were able to build on some momentum from Thursday and close above the line of support so we are recommending FLOATING your Delaware Mortgage Rate to start the week.

In Economic News, the Federal Reserve met last week and decided to continue to taper their asset purchase program called QE3. They tapered by another $10 Billion reducing the number of mortgage bonds and treasuries they are purchasing each month from $25 Billion to only $15 Billion per month. The next meeting of the Feds is October 29th and it is expected they will end the asset purchase program at that time by tapering the final $15 Billion. How exactly mortgage rates will react remains to be seen.

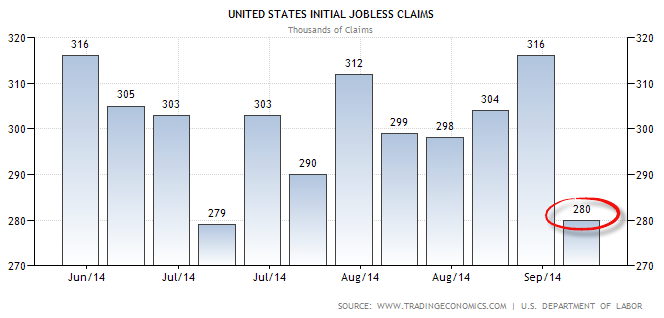

Thursday saw the release of the Weekly Initial Jobless Claims which dropped 36k claims from the previous week to 280,000 claims. This was much better than the 305,000 claims expected. This report was the lowest jobless claims since July 2014. This report points to a strong Jobs Report for September 2014.

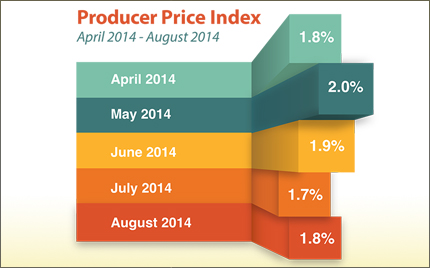

We also saw two reports last week on inflation, the Consumer Price Index (CPI) and the Producer Price Index (PPI). Both reports showed inflation remained tame. The CPI dropped from 2.0% to 1.7% which measures inflation at the consumer level. The PPI came in at 1.8% year over year which is below the 2.0% Fed target. The PPI measures inflation at the wholesale level which is the costs of goods and services used in the manufacturing of consumer goods. Inflation remaining tame is good news for mortgage rates as it helps keep the bond market from selling off and causing interest rates to rise.

We also saw two reports last week on inflation, the Consumer Price Index (CPI) and the Producer Price Index (PPI). Both reports showed inflation remained tame. The CPI dropped from 2.0% to 1.7% which measures inflation at the consumer level. The PPI came in at 1.8% year over year which is below the 2.0% Fed target. The PPI measures inflation at the wholesale level which is the costs of goods and services used in the manufacturing of consumer goods. Inflation remaining tame is good news for mortgage rates as it helps keep the bond market from selling off and causing interest rates to rise.

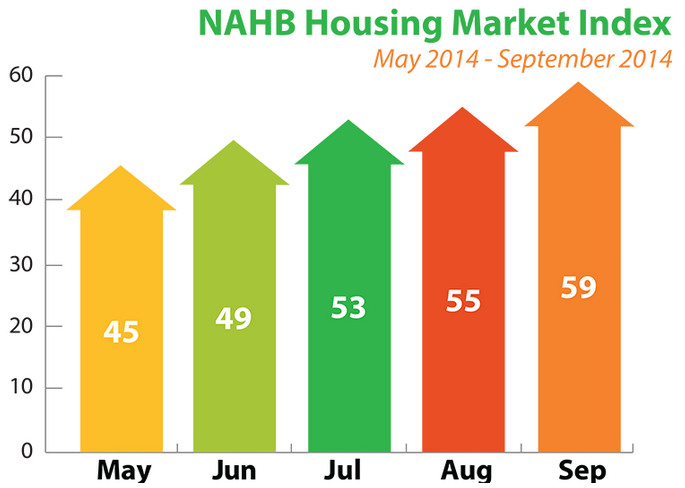

In Housing News, the National Association of Home Builders released their Housing Market Index for September 2014 and it increased 4 points to 59 from 55 in August. This was the highest level since November 2005. The NAHB Housing Market Index measures the home builder sentiment on the housing market and a reading of 59 shows home builders have a very positive outlook on the housing market.

In Housing News, the National Association of Home Builders released their Housing Market Index for September 2014 and it increased 4 points to 59 from 55 in August. This was the highest level since November 2005. The NAHB Housing Market Index measures the home builder sentiment on the housing market and a reading of 59 shows home builders have a very positive outlook on the housing market.

In other Housing News, we saw two reports on New Construction for single family homes, Housing Starts and Building Permits. Housing Starts for August 2014 came in at 956k units which were a decline of 14.4% from July 2014. This seems negative at first look but last month’s number was actually revised even higher from 1.093 Million units to 1.117 Million units increasing last month’s gain to 23%! If we look at the last two months together, Housing Starts were up 4%.

In other Housing News, we saw two reports on New Construction for single family homes, Housing Starts and Building Permits. Housing Starts for August 2014 came in at 956k units which were a decline of 14.4% from July 2014. This seems negative at first look but last month’s number was actually revised even higher from 1.093 Million units to 1.117 Million units increasing last month’s gain to 23%! If we look at the last two months together, Housing Starts were up 4%.

Building Permits for August 2014 came in at 998k units which were a decline of 5.6% from July’s Report. But again July’s figure was revised higher from 1.052 Million units to 1.057 Million units. If we look at the last two months of Building Permits and average them, permits are still up 3%. So these reports still show new construction is still strong.

Building Permits for August 2014 came in at 998k units which were a decline of 5.6% from July’s Report. But again July’s figure was revised higher from 1.052 Million units to 1.057 Million units. If we look at the last two months of Building Permits and average them, permits are still up 3%. So these reports still show new construction is still strong.

Fannie Mae announced it will be discontinuing the Homepath Mortgage Loan Program effective October 6, 2014. If you want to use the Homepath or Homepath Renovation Loan Program you will need to be under contract before October 6, 2014. You can read the full story Homepath Update

Fannie Mae announced it will be discontinuing the Homepath Mortgage Loan Program effective October 6, 2014. If you want to use the Homepath or Homepath Renovation Loan Program you will need to be under contract before October 6, 2014. You can read the full story Homepath Update

The next Delaware First Time Home Buyer Seminar is Saturday, October 18, 2014, in Newark, Delaware or Dover Delaware First Time Home Buyer Seminar Saturday, October 11, 2014, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, September 27, 2014, in Towson, Maryland and Frederick Maryland First Time Home Buyer Seminar on October 11, 2014, in Frederick, Maryland and Laurel Maryland First Time Home Buyer Seminar on October 8, 2014. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com.

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713